Time of Supply under GST, Principles of Time of Supply

Introduction

In GST regime, the tax collection event will be earliest of certain dates analysed in the following paras. The various events like issuing invoice/ making payment in case of supply of goods/ services or completion of event-in case of supply of service triggering the tax levy, confirms that the Government wants to ensure tax is collected at the earliest point of time. This will be altogether a new concept for the current VAT and Central Excise taxpayers. There are multiple parameters in determining ‘time’ of supply. Thus, businesses will face a huge challenge in maintaining records while reconciling between revenue as per financials and as per GST.

Principles of Time of Supply for Goods and/or Services [Clause 12 to 14 of the CGST Bill, 2017]

The taxable event under the GST regime shall be ‘supply’ of goods and/or services. However, the time of supply when the liability to pay CGST/ SGST (Intra-state) or IGST (inter-state) on goods and/or services arises, shall be determined in the following manner: I General Provision The time of supply of goods and services shall be determined as under: As regards the time of supply of goods, the Government (on the Councils’ recommendation) is yet to notify the categories of goods or supplies in respect of which a tax invoice is mandatorily required to be issued. It is important to note here that unlike services, where Service Tax is payable on accrual basis, applicability of tax on advance payment received is going to be a new phenomenon for goods taxability in GST. GST would be payable on advance amount received in respect of both goods and services provided such advance is linked to the supply of goods and/or services Further, insertion of a provision relating to date of entry in books of account of recipient as one of the parameters to determine time of supply for services is bound to create litigation as it is not possible for an assessee to identify the date on which recipient of services shows the receipt in his books of account.

Provisions for raising invoice:

Where amount up to Rs 1,000/- is received in excess of amount indicated in an invoice, the time of supply to the extent of such excess amount shall, at the option of the said supplier, be the date of issue of invoice.

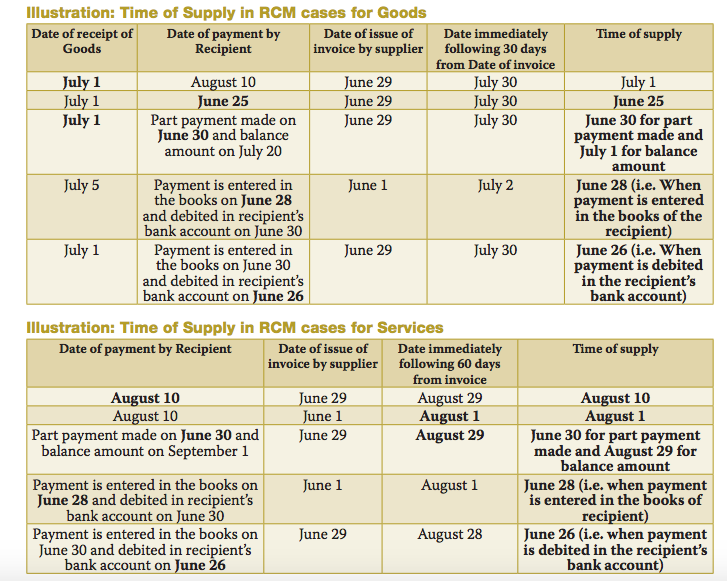

Supply under Reverse Charge Mechanism (“RCM”)

The time of supply of goods and services shall be determined as under:

Supply of Vouchers [Clause 12(4) and Clause 13(4)]

In case of supply of vouchers, by whatever name called, by a supplier, the time of supply for goods and services shall be:

(a) Date of issue of voucher, if the supply is identifiable at that point; or (b) Date of redemption of voucher, in all other cases.

Residuary provision [Clause 12(5) and Clause 13(5)]

Where it is not possible to determine time of supply under the above provisions, time of supply for goods and services shall be

(a) In a case where a periodical return has to be filed-Date on which such return is to be filed (b) In any other case-Date on which the CGST/ SGST or IGST is paid

In case of addition in value of supply by way of interest, late fee or penalty for delayed payment of consideration [Clause 12(6) and Clause 13(6)] The time of supply to the extent it relates to an addition in the value of supply by way of interest, late fee or penalty for delayed payment of any consideration shall be the date on which the supplier receives such addition in value.

Change in the Rate of Tax in Respect of Supply of Goods or Services

Here, the provisions provided under the GST Law are drawn on similar line as existing Rule 4 of the Point of Taxation Rules, 2011 (“POTR”). In other words, determination of rate of tax depends upon three important events viz.:

Date of supply of goods or services, Date of invoice; and Date of receipt of payment.

Thus, the rate of tax would be the one prevailing when two out of three events occur either prior to or after the date of change in rate of tax.

Continuous Supply of Goods // Services and Goods Sent on Approval

There are no express provisions relating to determination of time of supply in case of continuous supply of goods and/or services and in respect of goods sent on approval basis. One can thus, safely infer, that the above methods of determining the time of supply would equally apply to ‘continuous supply’ and goods sent on approval as well. Conclusion Most provisions are borrowed from the present Point of Taxation Rules, 2011 under the Service tax laws, with some modifications. Determination of the time of supply provisions under forward charge for goods has been mainly limited to the following two parameters:

Date of issue of invoice or the last date on which the invoice is required to be issued Date of receipt of payment

For services, the parameters are drawn on similar line as existing Service tax provisions with additional aspect of entry in books of accounts of recipient as one of the parameters. However, still no provision is provided in the CGST Bill to determine the time of supply where goods or services becomes taxable for the first time under GST regime as provided under Section 67A of the Finance Act, 1994 read with Rule 5 of the Point of Taxation Rules, 2011. In essence, ascertaining the ‘time of supply’ is crucial for the purpose of determining the taxable event and payment of taxes. Recommended Articles

GST Scope GST Return GST Forms GST Rate GST Registration What is GST? GST Invoice Format GST Composition Scheme HSN Code GST Login GST Rules GST Status Track GST ARN Time of Supply