The objective of imposing restrictions on cash transactions is to curb the flow of domestic black money which is not only adversely affecting the revenues of the Government but is also affecting the investment for productive purposes, because most of the black money is transacted in cash, it remains unaccounted and quite a sizable amount remains unproductive and is stored in the form of cash or remains invested in low priority investments such as gold, jewellery etc. The restrictions are intended to move towards a less cash economy and to reduce generation and circulation of black money.

Restriction on Cash Transactions under Income Tax Act

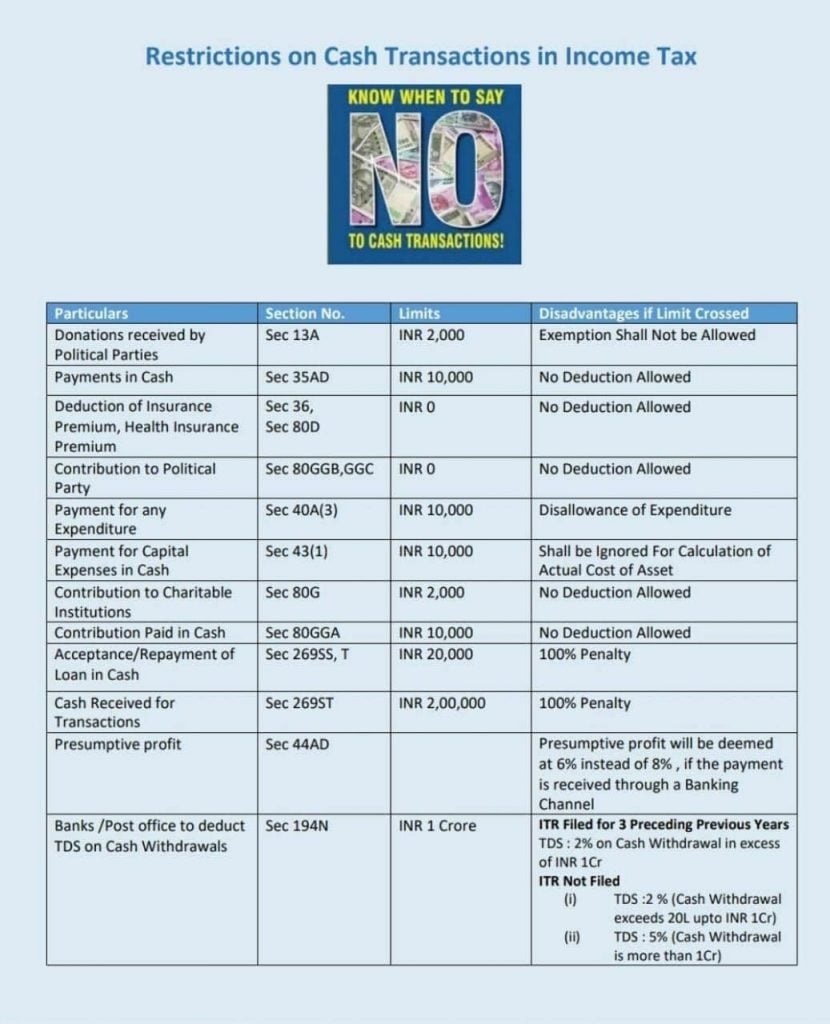

In a bid to curb black money as well as to limit the number and amount of cash transactions, the government has come out with some new provisions and related rules and prohibited some types of cash payments in the Finance Acts. The effects of restrictions under provisions of income tax act are as follows.

Restrict cash transactions which results disallowances of expenses or deduction under chapter VIA of income tax act in computation of taxable income and allowing deduction to incentivise better compliance.Penalising cash transactions above threshold limits to create effective deterrence.

Few of the provisions under income tax act and relevant income tax rules are given below: It may be noted that the specified mode of payment namely, crossed account payee cheque or draft as stated in the relevant sections above has been expanded by Finance Act 2017 to include any payment through the use of electronic clearing system through a bank account. Such a clearing system may include Real Time Gross Settlement (RTGS), credit card or debit card payments and even payments through the Aadhaar Card System. As amended in Finance Act 2017, to discourage cash transaction and to bring transparency in the source of funding to political parties, the amendments have been made. (i) No donation of ₹ 2,000 or more is received otherwise than by an account payee cheque/draft/use of electronic clearing system through a bank account or through electoral bonds. (ii) Political parties keeps and maintains such books of accounts to satisfy the Assessing Officer and such accounts to be audited by an Accountant as prescribed under income tax act. (iii) Income tax return to be filed under section 139(4B) & within time limit prescribed under section 139(1). If return of income as required u/s 139(4B) is not submitted or if return is submitted belatedly that is after the due date, exemption u/s 13A will not be available. Prior to Finance Act 2017, there was no restriction on deduction of capital expenditure as stated above in case acquisition of any capital asset in any mode of payment. To discourage cash payment for purchase of capital assets, section 35AD and section 43(1) have been amended with effect from the assessment year 2018-19 as follows: (i) No deduction under section 35AD shall be allowed in respect of payment or aggregate payment per day made to a person against such expenditure otherwise, than an account payee cheque/draft/use of electronic clearing system through a bank account exceeds ₹ 10,000. (ii) Section 43(1) is amended to provide that where an assessee incurs any expenditure for acquisition of any asset in respect of which a payment or aggregate payment made to a person in a day, otherwise than by cheque or bank draft or electronic clearing system exceeds ₹ 10,000/-, such payment shall be ignored to determine the actual cost of such asset (i)Will not form part of “ actual cost” u/s 43(1) and consequently depreciation u/s 32 and investment allowance u/s 32AD pertaining to such payment cannot be claimed. In order to disincentives cash transactions, section 40A (3) has been amended and limit of cash payment per day to a person has been reduced from ₹ 20,000 to ₹ 10,000 from assessment year 2018-19. However no changes to the monetary limit of ₹ 35,000has been made in the case of payment for plying, hiring or leasing of goods carriage which was effective from October 2009.The disallowances to be applicable if the payment made in a day to a person otherwise than an account payee cheque/draft/use of electronic clearing system through a bank account. As per section 40A(3A), the restriction is also applicable

If the tax payer had claimed a deduction in respect of any expenditure relation to any previous year. Payment to such expenditure is made during the current year.

If during the current year payment made in a day otherwise than by an account payee cheque or account payee demand draft/use of electronic clearing system through a bank account exceeds ₹ 10,000. This monetary limit has also been reduced from ₹ 20,000 to ₹ 10,000 from the assessment year 2018-19. In order to provide cash less economy and transparency, section 80G has been amended by Finance Act 2017, so as to provide that no deduction shall be allowed under the section 80G in respect of donation of any sum exceeding ₹2,000/- unless such sum is paid by any mode other than cash. (a) the amount of such loan or deposit or the aggregate amount of such loan and deposit ; or (b) on the date of taking or accepting such loan or deposit, any loan or deposit taken or accepted earlier by such person from the depositor is remaining unpaid and the amount or the aggregate amount remaining unpaid ; or (c) the amount or the aggregate amount referred to in clause (a) together with the amount or the aggregate amount referred to in clause (b), is ₹ 20,000 or more: The limit of ₹ 20,000 will also apply to a case even if on the date of taking or accepting such loan or deposit, any loan or deposit taken or accepted earlier by such person from such depositor is remaining unpaid and such unpaid amount along with the loan or deposit to be accepted, exceeds the aforesaid limit. “Specified Sum” means any sum of money receivable whether as advance or otherwise, in relation to transfer of an immovable property, whether or not transfer takes place. However by virtue of section 273, the above penalty is not leviable if the assessee proves that there was a reasonable cause for the failure in compliance of the provisions (a)The amount of the loan or deposit together with interest is ₹ 20,000 or more, or (b) The aggregate amount of loans or deposits held by such person, either in his own name or jointly with other person on the date of such repayment together with interest, is ₹20,000 or more However by virtue of section 273, the above penalty is not leviable if the assessee proves that there was a reasonable cause for the failure in compliance of the provisions As per proviso of section 269SS and section 269T, section is not applicable on any loan or deposit taken or accepted from:- (a) Government (b) any banking company, post office savings bank or co-operative bank (c) any corporation established by a Central, State or Provincial Act. (d) any Government company as defined in section 617 of the Companies Act, 1956 (1 of 1956) (e) such other institution, association or body or class of institutions, associations or bodies which the Central Government may, for reasons to be recorded in writing, notify in this behalf in the Official Gazette. (i) In aggregate from a person in a day (Example: if a person receives ₹ 2. 25 lakhs in cash against two different invoices raised for the service provided/goods supplied amounting to ₹ 1 lakhs and ₹ 1.25 lakhs). or (ii) In respect of a single transaction. (Example: If there is a single invoice for service provided/goods supplied amounting to ₹ 2.90 lakhs against which cash has been received on different days for ₹ 1.6 lakhs and ₹ 1.30 lakhs) or (iii) In respect of transactions relating to one event or occasion from a person. (Example: If birth day celebration is one occasion and a person receives amount of ₹ 2.50lakhs) (iv) Otherwise than by an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account. Provisions of this section shall not apply to any receipt by (i) Government/any banking company, post office savings bank or co-operative bank; (ii) Transactions of the nature referred to in section 269SS – i.e. acceptance of Loan, deposits etc, (iii) Such other persons or class of persons or receipts etc.that may be notified by the Central Government. (iv) Persons from whom the loan or deposit is taken or accepted and if the person by whom the loan or deposit is taken or accepted are both having Agricultural Income and neither of them has any Income chargeable to Tax. (v) Any corporation established by a Central, State or Provincial Act It is further clarified that the receipt of one installment of loan repayment in respect of a loan shall constitute a ‘SINGLE TRANSACTION’ as specified in clause (b) of section 269ST of the Act and all the installments paid for a loan shall not be aggregated for the purposes of determining applicability of the provisions section 269ST. However, penalty is not leviable by the Joint Commissioner if it is proved by such person that there is a good and sufficient reason for such contravention. Promotion of digital payment to an eligible assesse covered in section 44AD The existing provisions of section 44AD of income tax act, inter-alia, provides for a presumptive income scheme in case of eligible assesses (individuals, HUFs and firms excepting LLPs) carrying out eligible businesses. As per provisions under above scheme, in case of an eligible assessee engaged in eligible business having total turnover or gross receipts not exceeding two crore rupees in a previous year, a sum equal to eight per cent of the total turnover or gross receipts deemed to be his business income chargeable to tax under the head “profits and gains of business or profession”. Amendment provisions in Finance Act provides for lower presumptive profit rate of 6% on turnover realized in account payee cheque or DD or electronic clearing system through a bank account on or before due date for filing Income Tax Return. The amendment is made in Finance 2017 (effective from assessment year 2017-18) in order to promote digital transactions and to encourage small unorganized business to accept digital payments by reducing the existing rate of deemed total income of 8% to 6% in respect of the amount of such total turnover or gross receipts received by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account during the previous year or before the due date specified in sub-section (1) of section 139 in respect of that previous year. However, the existing rate of deemed profit of 8% referred to in section 44AD of the Act, shall continue to apply in respect of total turnover or gross receipts received in any other mode. Assesses availing presumptive scheme under section 44AD must keep in view the provisions of section 269ST (as stated above) as also provisions of section 206C(TCS) while accepting cash payments/advances from customers. While concluding, it may be noted that, by making few provisions under income tax act are not only measures to eliminate black money. No doubt a tax payer is required to adhere to all the provisions of income tax for tax compliances and to get tax benefits. But at the same time, more innovations will be required to route transactions through the banking system. As more transactions go through banking channels, reporting of income and tax compliance will improve leading to higher tax revenues. Higher tax revenues would, ideally, lead to lower tax rates, which will benefit all tax payers. Recommended

Income TaxDepreciation rates as per companies act 2013