Return GSTR 2A > View of Inward Supplies Return

How can I view the Inward Supplies Return GSTR 2A?

GSTR2A will be generated in below scenarios,

When the supplier uploads the B2B transaction details in GSTR-1& 5/ &ISD details will be auto-populated on submission of GSTR-6 by the counterparty / &TDS & TCS details will be auto-populated on filing of GSTR-7 & 8 respectively by the counter party.

GSTR2A is a Read view form only and you cannot take any action in GSTR2A. GSTR-2A will be generated in the following manner. When GSTR – 2 has not been submitted by the taxpayer, the details will be auto-populated to GSTR-2A of current tax period if –

Counterparty adds Invoices / Credit notes / Debit Notes /Amendments in GSTR-1/5GSTR-6 is submitted for distribution of credit in the form of ISD creditGSTR-7 & 8 filed by the counterparty for TDS & TCS credit respectively.

To view the Inward Supplies Return GSTR2A, perform the following steps:

- Access the www.gst.gov.in URL. The GST Home page is displayed.

- Login to the GST Portal with valid credentials.

- Click the Services > Returns > Returns Dashboard command.

- The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to file the return from the drop-down list.

- Click the SEARCH button.

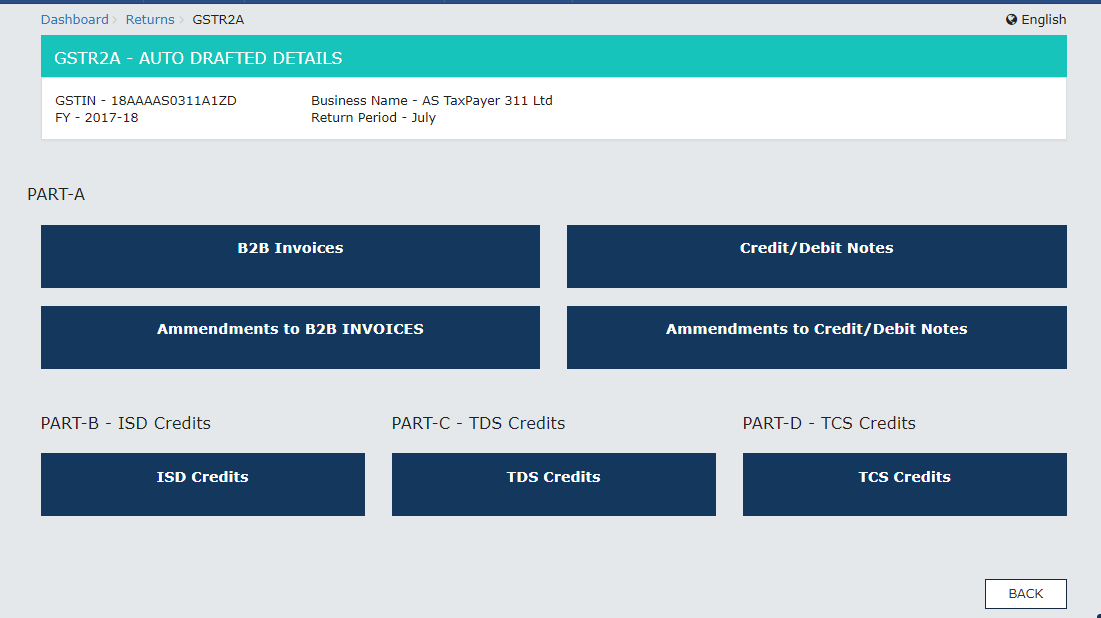

- The File Returns page is displayed. In the GSTR 2A tile, click the VIEW button. The GSTR2A – AUTO DRAFTED DETAILS page is displayed. Click the tile names to know more details: PART- A

• B2B Invoices• Amendments to B2B INVOICES• Credit/Debit Notes• Amendments to Credit/Debit NotesPART- B – ISD CreditsPART- C – TDS CreditsPART- D – TCS Credits

PART- A (B2B Invoices)

B2B Invoices displays all the invoices added by the supplier through their GSTR 1 and/ or GSTR 5. The B2B section of PART A of GSTR 2A is auto-populated on uploading or saving of invoices by the Supplier in their respective returns of GSTR 1 and GSTR 5.

- Click the B2B Invoices button. The B2B Invoices – Supplier Details page is displayed.

- Click the GSTIN hyperlink to view the invoices uploaded by the supplier.

- Click the Invoice No. hyperlink to view the invoice details. The item details are displayed.

PART- A (Amendments to B2B Invoices)

Amended B2B Invoices section covers the invoices which are amended by the supplier in their returns of GSTR-1/5 respectively.

- Click the Amendments to B2B Invoices button. The Amend B2B Invoice page is displayed. PART- A (Credit/Debit Notes) This section covers the Credit/Debit notes added by the supplier in their respective returns (GSTR-1/5).

- Click the Credit/Debit Notes button. The Credit/Debit Notes – Supplier Details page is displayed.

- Click the GSTIN hyperlink to view the credit or debit notes uploaded by the supplier.

- Click the Credit/Debit Note No hyperlink to view the details. The item details are displayed. PART- A (Amendments to Credit/Debit Notes) Amendments to Credit/Debit Notes section covers the amendments of Debit / credit notes done by the supplier in their respective returns (GSTR-1/5).

- Click the Amendments to Credit/Debit Notes button. The Amend Credit/Debit Notes – Supplier Details page is displayed.

PART- B (ISD Credits)

- Click the ISD Credits button. The ISD Credit Received page is displayed. PART B of GSTR 2A is auto-populated from GSTR-6. PART- C (TDS Credits)

- Click the TDS Credits button. The TDS Credit Received page is displayed. PART C of GSTR 2A is auto-populated on filing of GSTR-7 by TDS Deductor. PART- D (TCS Credits)

- Click the TCS Credits button. The TCS Credit Received page is displayed. PART D of GSTR 2A will be auto-populated on filing of GSTR-8 by TCS Collector. Recommended Articles